The container ship, Compagnie Maritime d’Affrètement and Compagnie Générale Maritime (CMA CGM) Benjamin Franklin, entering the Port of Long Beach. Photo Source: CMA CGM

4. How Ship Traffic in Our Ports is Affected by COVID-19

Author: Dr. James A. Fawcett, USC Sea Grant Maritime Policy Specialist/Extension Director (retired)

Media Contact: Leah Shore / lshore@usc.edu / (213)-740-1960

An organization called The Marine Exchange of Southern California (MXSOCAL) tracks all vessels of more than 300 gross tons entering or leaving the Port of Los Angeles (POLA) or Port of Long Beach (POLB), as well as in the waters between Point Conception in Santa Barbara County and the Mexican border. This tracking gives us a very accurate picture of the amount and trends in vessel traffic in the two ports. Since about 40% of all import cargo to the United States enters through the Port of Long Beach (POLB) or Port of Los Angeles (POLA), our ports are a reliable indicator of economic activity in the U.S., especially with respect to consumer goods.

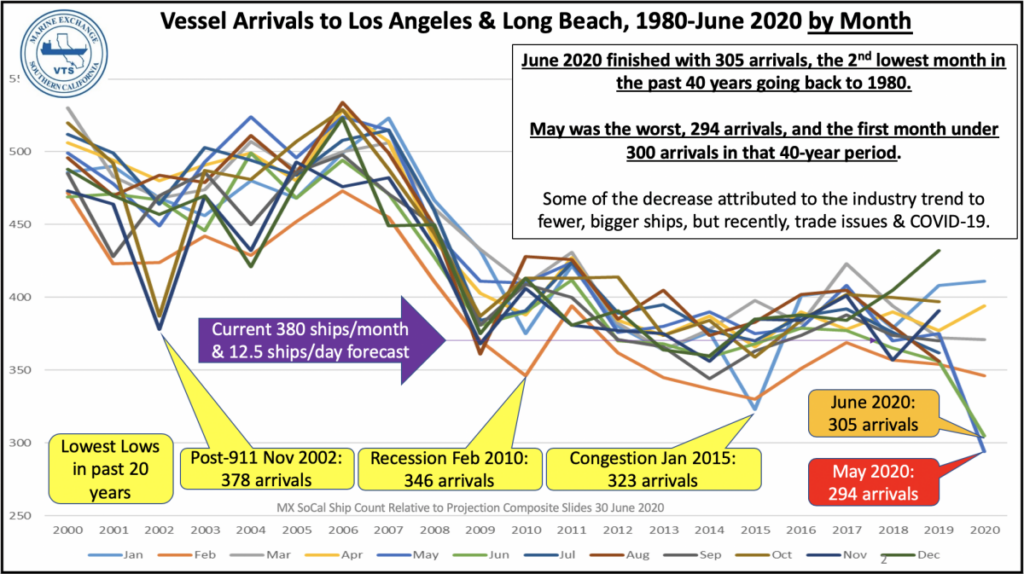

One question being asked often these days is whether COVID-19 has affected ship traffic. Using a baseline of ship traffic from 2018 and 2019 data, we can conveniently compare the first six months of 2020 with similar periods in the two previous years. The two prior years show an arrival average of 12.5 ships per day between January and April, and similarly, in 2020 between January and April, the arrival average was 12.6 ships per day. However, in May and June 2020, arrivals dropped to 9.8 ships per day, a 21% decline compared to 2018 and 2019.

When we examine the types of ships (and therefore cargo types) that have shown big declines this Spring, we can see that the passenger/cruise ships have taken the hardest hit. In the first six months of this year, 99 fewer passenger ships came through the ports, known in port terms as “calling,” than in previous years. As we know from articles in the press, the public is avoiding cruises for good reason. In prior years, the POLB and POLA hosted about 190 vessels for the first six months of the year, but this year almost all of the port calls –only 92– were in the January to March period. Since March, virtually no passenger ships have called.

Usually, container ships are the most frequent callers to the two ports as they largely bring in finished goods made overseas, but their numbers have been considerably reduced, as well. The “normal” volume is just over 1,000 container ships for the first six months of the year. But, this year, the volume has dropped a little over 13% to 893 port calls. This has particular importance because these are the vessels bringing in manufactured goods and consumer products, many of which will move from the ports to the retailer’s shelves. May was the worst month yet with only 132 container ships arriving, 44 short of the “normal” 176. June showed a modest increase in container ship port calls and finished only 17 short of “normal”. July marks the beginning of what is normally the busy season as retailers bring in fall and winter clothing and stock up for the holiday buying season. Tracking container traffic in July and August will provide us with a better picture of that demand and the effects of COVID on shipping traffic.

Vehicle carriers (roll-on/roll-off ships) are also important to note because many of the cars we see on the road are foreign-built. These foreign-built cars get here by giant vehicle carriers that have a capacity of about 5,000 cars– imagine a floating parking garage! In a normal year, about 18 of these behemoths will call at the ports each month, but in May and June 2020, their numbers were drastically down with only nine calling in May and only six in June. As we all are aware, if the economy is sluggish, Americans will not be shopping for cars as often, and the manufacturers will reduce production accordingly.

Because of our poor air quality in Southern California, laws require that we must make our own cleaner gasoline here and cannot import it from other parts of the country. As a result, tankships (tankers) bring in crude oil on a regular basis for our many oil refineries in Carson, San Pedro, Wilmington, and Long Beach. However, our demand for refined gasoline determines how much crude oil we need, so tanker visits have been about 28% lower than our normal baseline. Although in June, deliveries appeared to be returning to normal levels.

Interestingly, there has been one type of port call that has increased this year, although not due to COVID-19. Effective January 1, 2020, the International Maritime Organization changed ship emissions requirements worldwide, and one of the alternatives was for ships to shift from 3.5% sulfur fuel to 0.5% low sulfur fuel that is seven times cleaner. Local refineries quickly responded and made the required fuel available and affordable. During the first six months of the year, 136 more ships “stopped by” POLA and POLB to refuel than the year before, a 73% increase. The high was during the month of April, where 94 ships arrived only to refuel, more than triple the number that came here only to refuel last year. They anchor inside the breakwater, take on fuel, and leave the area without delivering or loading any cargo. This traffic has returned to normal levels as this low emission fuel has become more widely available elsewhere. (Just to note, within 200 miles off the coasts of the U.S. and Canada in what is called the Emission Control Area, ships were already required to use even cleaner 0.1% very low sulfur fuel).

Just south of the ports, offshore of Seal Beach and Huntington Beach is an array of anchorages commonly used by ships that need to wait for a variety of reasons. The number of anchored ships there fluctuates weekly. Ships routinely anchor for up to a week to change crews, resupply, wait for their berth in the port to be available, or wait for their next load after unloading. However, since COVID-19 began, one vessel stands out. The National Geographic Orion, a 100-passenger luxury ice-class cruise ship, has been on an anchorage for the past couple of months. The duration of her stay at anchor is still undetermined at this time.

Dry bulk carriers (vessels filled with minerals, grain, scrap metal, and other non-containerized bulk cargoes) usually make about 120 port calls each winter and spring. In the LA region, we tend to be exporters of minerals, chemicals, and scrap metals including various types of food-grade products (tallow, cottonseed, and coconut oils). This year, bulk-carriers have called in the ports about 11% below normal levels. Often an increase in bulk carriage (especially imports) is an early indicator of increased industrial production that might be expected in six to nine months.

In summary, we saw little change in vessel port calls in the first three months of 2020, followed by a rapid decline in May and June. May had 294 arrivals and in June there were 305, almost 20% below expectations and the lowest two months in 40 years. If we think of ship traffic as an indicator for future business activity, the decline may be a cautionary statistic. However, we are at the start of the normal busy season, and U.S. businesses may be acting cautiously, waiting to determine the impact of the COVID-19 virus on consumer demand. We will know more when third-quarter statistics become available at the end of September and will report them at that time. In the meantime, across all categories of vessels, for the past six months of 2020, the ports appear to be operating about 15% below the trend of the past two years.