After tax cuts derailed the ‘California dream,’ is the state getting back on track?

In 1978, the year I graduated from college with a degree in economics, most voters in my state chose to turn their backs on the “California dream.”

Not unlike the American dream, California’s iteration focused on the limitless possibilities awaiting anyone who moved to the state. It was the state’s basic philosophic footing, a social compact that connected generations, geographies and economic classes in a common destiny.

Proposition 13, which Californians approved in a referendum in June 1978, marked a turning point away from the kind of public investment in education, infrastructure and social services – as well as a shift in an attitude that welcomed all comers – that made the California dream a reality for so many.

The highly controversial measure slashed property taxes, impoverished local governments and made it very hard for the state to raise new revenues. Besides ushering in an era of underinvestment, it spread the fantasy – since gone national – that governments can cut taxes without reducing services.

Almost 40 years later, California is at a crossroads and may finally be ready to begin to reverse Prop 13’s damage. As I explore in a forthcoming book, the state is pushing against the national grain by protecting immigrants, tackling climate change and raising the minimum wage. And most significantly for the legacy of Proposition 13, more residents are coming to see how replenishing the state’s coffers is key to restoring prosperity.

Pulling up the drawbridge

Just days after Proposition 13 passed, I stood in front of my fellow graduates at the University of California, Santa Cruz, to give the student address. I chose to talk about the result of the vote – not because it had anything to do with my chosen field of study but because of the sharp rift with the past it represented.

California had invested in me, like millions of others, by funding quality public schools, a world-class university system and economic growth. Now, a majority of voters were seeking to selfishly pull up the drawbridge on future generations. So I spent my 15 minutes of fame in front of classmates, professors and parents explaining why I thought Prop 13 would shipwreck the state.

I wish I had been wrong – and that I’d spent more of my allotted time thanking my parents, neither of whom had finished high school and were beaming with pride because the California dream had come true for their son. Sadly, Prop 13 meant that dream would be much less likely to come true for others.

At its core, Proposition 13 was written as an amendment to the state’s constitution with three key elements and affected all types of property, from residential to commercial:

-

It rolled back assessed property values to their estimated market value in 1975 and limited annual increases to no more than 2 percent as long as the property wasn’t sold. With any new sale, the assessed value could climb to the actual sale price, essentially locking in the property tax for long-time homeowners and shifting the burden to newcomers.

-

It capped the property tax rate at 1 percent of the assessed value for city, county, school and other local governments, down from an average of 2.6 percent before the measure, draining local coffers.

-

It mandated that any change in state taxes that would increase the tax take would require a two-thirds vote in the legislature (while tax cuts required only a majority vote) and that any increase in designated or special purpose taxes by local governments would require two-thirds voter approval. This effectively staightjacketed the ability of a changing electorate to raise new revenues.

Howard Jarvis, right, joins Gov. Jerry Brown at a news conference after Proposition 13 passed. AP Photo/Robbins

Howard Jarvis, right, joins Gov. Jerry Brown at a news conference after Proposition 13 passed. AP Photo/Robbins

Prop 13 and its racial undertones

One reason for Prop 13’s popularity was that the median value of a house in California rose by over 250 percent from 1970 to 1980, more than twice as fast as median household income in the state. With reassessments triggering property tax hikes that outpaced family finances, the die was cast for a taxpayer rebellion.

But the roots of this suburban-based revolt were far deeper than a fight over taxes. The forces behind it were the same ones that fought against fair housing in the 1960s and busing to promote school integration throughout the 1970s. And they were goaded by a series of court decisions that mandated the equalization of school spending across districts, stirring white resentment that local property tax dollars were not being spent on “our kids.”

Indeed, at the same time that property rates were soaring, the share of youths who were minorities rose from 30 percent in 1970 to 44 percent by 1980 – the largest decadal change in California’s history. And while these racial undertones were, well, undertones, the resentment of the changing demography was clear when Prop 13’s main architect, Orange County businessman Howard Jarvis, wrote after it passed that immigrants “just come over here to get on the taxpayers’ gravy train.”

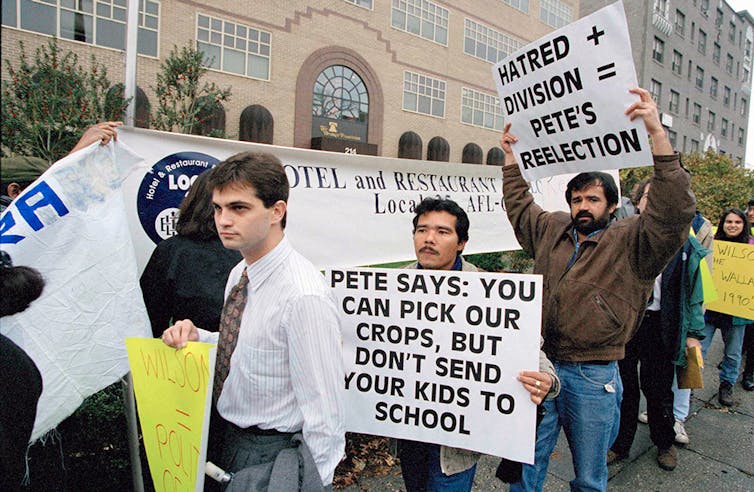

Protesters demonstrate against California’s Proposition 187 outside the Heritage Foundation in Washington in 1994 as then-Gov. Pete Wilson speaks inside. AP Photo/Joe Marquette

Protesters demonstrate against California’s Proposition 187 outside the Heritage Foundation in Washington in 1994 as then-Gov. Pete Wilson speaks inside. AP Photo/Joe Marquette

In essence, Proposition 13 became the first shot across the bow in a series of referendums some dubbed “racial propositions” that reached their apogee with Proposition 187, the famous 1994 measure that sought to cut off nearly all public services, including education, to undocumented immigrants.

That was followed by voter-approved measures to ban affirmative action, eliminate bilingual education and expand a prison system marred by racial disproportionality in its sentencing and rates of incarceration.

That Prop 13 itself was a sort of generational warfare with overtones of race was clear in its structure. Since the assessment didn’t increase more than 2 percent unless property changed hands, incumbent homeowners (who were older and whiter) wouldn’t see their tax burden change much as long as they didn’t sell. Meanwhile, new homeowners (more likely to be younger, minority and eventually immigrant) would have to pay higher tax rates and thus bear a disproportionate share of the costs of local services.

And that wasn’t the only bias against the future. The requirement for a supermajority to pass legislation to raise taxes effectively constrained the ability of future state governments to pour in the sort of money that had built the state’s famed transportation, water and university systems.

The consequences

The immediate damage from Prop 13, however, was masked. When local property tax revenues quickly fell by about 60 percent, the state government stepped in to fill the gaps.

But over time, the damaging effects of Proposition 13 in terms of education spending and income inequality became increasingly apparent. In the 1960s, California ranked among the top 10 states in terms of per-pupil spending. By 2014, its ranking had plunged to as low as 46. And while California’s level of income inequality was in the middle of the pack nationally in 1969, it is now the fourth most unequal state in the country.

While Proposition 13 was not the only culprit behind these trends, it didn’t help. About half of the total residential property tax relief provided by Prop 13 went to homeowners with incomes in excess of US$120,000 a year – or about 15 percent of all households.

And because the property tax was no longer a growing source of revenue for local governments, cities and counties had more reason to chase sales taxes with retail development and less incentive to promote housing, helping to set in motion the severe housing shortage that wracks the state today.

The final irony is that Prop 13 – a measure promoted by those in favor of smaller government – pushed authority and decision-making to the state capitol, which became the main source to bail out local municipalities.

Efforts to change it

So why has Proposition 13 not been overturned?

Its political appeal remains, particularly to older residents who vote and to businesses worried about any increase in taxes. Efforts to keep the protections for residential homeowners but allow commercial and industrial property to be assessed at market rates – a so-called “split roll” – have failed or stalled and currently command the thinnest possible majority in public polling.

So while the split role remains a goal for some reformers, many concerned about the effects of Prop 13 have simply tried to raise taxes elsewhere to offset the lost revenue. California voters approved a temporary “millionaire’s tax” in 2012 and its long-term extension in 2016. And more than two-thirds of voting taxpayers in Los Angeles County approved sales tax hikes in 2008 and 2016 that will generate $160 billion over the next 40 years for transportation investments ranging from rail expansion to highway improvement to new bike paths.

But such tinkering does not solve the fundamental problems with Prop 13 that I’ve noted above. Addressing those will require a new set of conversations about optimal tax policy and how to address legitimate concerns such as how to protect older homeowners with a fixed income from the potential end of Prop 13.

President Trump’s ‘Make America Great Again’ plans follow a playbook similar to what resulted from Prop 13. AP Photo/Jae C. Hong

President Trump’s ‘Make America Great Again’ plans follow a playbook similar to what resulted from Prop 13. AP Photo/Jae C. Hong

California – and the country – at a crossroads

Unfortunately, the same demographic shifts, economic anxieties and political polarization that spurred Prop 13 have since gone national. The president’s plan to “Make America Great Again” similarly involves slashing taxes while underinvesting in education and social services – the kinds of investments that actually made America great in the 20th century.

California has the opportunity to show the nation how to get this right and invest in our future and our collective dreams rather than shortchange them. And a growing number of voices, including local governments, unions and political groups, are calling for reform.

So while the discussion about Prop 13 might seem to be about a few obscure tax rules, it is highly symbolic: At stake is the future of the state and, indeed, the nation. A day of reckoning for a measure that seems increasingly out of date may soon be upon us.

![]() Read more about the past and future of the California Dream. This series is published in collaboration with KQED.

Read more about the past and future of the California Dream. This series is published in collaboration with KQED.

Manuel Pastor, Professor of Sociology, University of Southern California – Dornsife College of Letters, Arts and Sciences

This article was originally published on The Conversation. Read the original article.