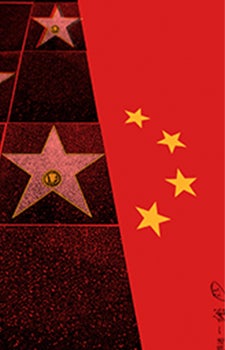

Wild for Movies

Marketing rule No. 1: When trying to make a buck, don’t alienate one of your largest audiences.

Case in point, in 2012, when MGM planned a remake of the 1984 Cold War film Red Dawn, in which a midwestern town is invaded by Soviet forces, they decided to recast the enemy with a more contemporary antagonist — China. Critics rushed to point out the flaws in MGM’s thinking. Among them was the fact that China has the second largest film market after North America, and getting the picture — or any films made by MGM — into the country would be impossible if China was cast as the adversary.

The People’s Republic of China, in a process overseen by the State Administration of Press, Publication, Radio, Film and Television (SAPPRFT), maintains a complicated quota system that allows only 34 foreign films into the country per year. Of those, 14 must be either IMAX or 3-D. Each film permitted to play in Chinese cinemas must also meet a certain set of standards, including casting the country in a positive light when there is a Chinese component.

In an effort to claim a foothold in China, MGM made an unprecedented move. In post-production, the studio replaced China with North Korea as the foe.

“The studio spent a considerable amount of money to digitally alter the film,” said Stanley Rosen, professor of political science. “But with North Korea as the enemy there was no challenge since there’s really no market for U.S. films there.”

For the U.S. movie industry, China is a critical market to crack. Domestic box office numbers have been floundering in recent years and engaging Chinese audiences may be the key to keeping the U.S. market afloat.

“It used to be that as much as 50 percent of the total box office for a film would come from the U.S. and Canada, but it’s not the case anymore,” said Rosen, an expert in Chinese politics and the relationship between Hollywood and China. “Now, a blockbuster film will make as much as 70 percent of its return outside of North America.”

China jumped ahead of Japan as the second-largest film market after North America in 2012. The following year, China’s box office receipts tallied $3.6 billion, and 2014 saw that figure increase 34 percent to $4.8 billion — making China the first international market to exceed $4 billion at the box office.

In February 2015, thanks to a movie-going boom during the Lunar New Year, Chinese box-office revenues exceeded those of the United States for the first time ever — $650 million versus $640 million, respectively, according to data from research firm EntGroup. Experts estimate that China will overtake North America as the top annual movie market within five years.

For now, North America’s box office is still leading the charge with a $10.3 billion payout last year — though that figure is down from $10.9 billion in 2013. To maintain its lead, the North American market will need fresh revenue sources.

Hollywood’s Next Move

So, how can the U.S. film industry make headway in China?

First off, filmmakers must consider how SAPPRFT will respond to the movies they submit for approval in China, explained Brian Bernards, assistant professor of East Asian languages and cultures.

“For instance, films cannot include negative images of the Communist Party of China. They also have to limit depictions of corrupt officials or superstitious representations, such as ghosts. There’s also the idea that anyone who is breaking the law should be punished by the end of the film.”

However, Bernards noted there are no hard and fast rules. Each film is judged on a case-by-case basis. In some instances leeway would be granted to Hollywood as long as it was clear to Chinese audiences that corrupt or superstitious practices would never succeed in China.

Some filmmakers are going one step further and tailoring their content to engage Chinese audiences.

There’s no better example than Transformers: Age of Extinction, which brought in $320 million in China, breaking box office records and in 2014 edging out Avatar as the highest grossing film of all time in that market. In the U.S., Transformers: Age of Extinction earned about $245 million.

Much of the film’s popularity in China has been attributed to how it was crafted to cater to Chinese audiences. Unlike Red Dawn, the fourth installment of the Transformers franchise purposefully incorporated Chinese elements from the outset. For instance, a portion of the film was shot in Beijing and Hong Kong, and well-known Chinese actors were included in the cast.

Political scientist Stanley Rosen points out that the 25 percent return American production companies earn on films released in China is much less than in other countries. However, the sheer scale of growth in the country’s film market still ensures overall profitability.

In his course “Politics and Film in the People’s Republic of China,” Rosen plays film clips that illustrate how movies cater to Chinese audiences. Many clips feature the use of product placement. In one, Stanley Tucci’s character takes a drink of Yili, a popular Chinese brand of milk. In another, Mark Wahlberg’s character uses a China Construction Bank ATM — in Texas.

Some films will also include scenes seen only by audiences in China, Rosen said.

“In Looper, for example, there are longer scenes that take place in modern Shanghai,” Rosen said. The filmmakers also included favorable mentions of China in the narrative. Jeff Daniels’ character in Looper tells Joseph Gordon-Levitt’s character to reconsider his decision to retire in France. “I’m from the future,” Daniels says. “You should go to China.”

When it comes to the types of film that do well in China, big blockbusters are typically the most successful.

“Blockbusters are the big hits all over the world and China is no different,” Rosen said. “But, there’s a lot of piracy in China and people can get films online or in very high-quality hard copies.”

So when it comes to enticing theatregoers, splashy visuals get them to shell out cash for a movie ticket.

“With a blockbuster that’s 3-D or IMAX, or has a lot of special effects, viewing it in a theatre makes a big difference,” Rosen said. “People are going to want to watch it in the best quality presentation, not on an iPhone or on a home device.”

To Cash-in, Co-Produce

Another option for gaining traction in the Chinese film market is for Hollywood studios to co-produce films with Chinese production companies. To placate SAPPRFT, those films must include a certain amount of Chinese content, but there are perks.

“One of the benefits of a co- production is that Hollywood studios can get as much as 43 percent of the box office receipts, whereas films that are solely American enterprises only take away 25 percent,” Rosen said. “That’s much less than anywhere else in the world for Hollywood, but in China they can still do very well and make money.”

Recently Kung Fu Panda 3 (2016), a joint venture between DreamWorks Animation, its Chinese unit Oriental DreamWorks and their Chinese partners, was granted co-production status by SAPPRFT.

Bernards, an expert in modern Chinese and Southeast Asian literature and cinema, met with DreamWorks Animation last year to speak about Chinese cinema and culture. He touched on how films, such as Kung Fu Panda 3, which target younger audiences, are a winning strategy for the Chinese market. Not many Chinese films are geared toward children.

“Using such animation techniques to transform China’s national animal icon into an anthropomorphic good-natured clown who dreams bigger for himself than being a noodle vendor hit home on different levels for many young Chinese viewers,” Bernards said. “What was remarkable about Kung Fu Panda was that it combined such a story with high quality animation and directed it toward children.”

The two elements of content and co-production status may be a winning combination for the third film in the franchise.

“Kung Fu Panda 3’s status as a co-production should allow it to circumvent some of the restrictions in terms of screening and increase its share of the domestic box office in China. It will also have greater access to the domestic Chinese market.

“Of course, because it’s a sequel it still needs to bring something novel to the table to attract the audiences,” Bernards added.

Breaking into Hollywood

Meanwhile, as China’s film market continues to grow, Chinese filmmakers are attempting to gain more market share in Hollywood. However, China faces an uphill battle to gain a foothold in the U.S.

“There’s investment in both directions, but it doesn’t change the fact that Chinese films don’t really have a market outside of China and some Asian territories,” Rosen said.

It’s hard for Chinese films to get into theatres aside from those considered art-house, which are a small fraction of the market, he said.

“Almost no foreign language films are successful in the U.S. market. Not just Chinese films, but French films or anything else. It’s a niche market. Anything that’s foreign language is arthouse by definition.”

One way that Chinese investors are making inroads is by buying their way into the North American market so they can put their films in front of American audiences. The Dalian Wanda Group, China’s largest entertainment group, purchased the AMC Theatres chain in 2012 for more than $2.6 billion.

So far the theatre chain, which shows films on more than 4,900 screens in the U.S., has successfully climbed on the New York Stock Exchange. However, it has experimented with bringing Chinese films to American audiences with little success.

“They took the film Lost in Thailand, which broke all box office records in China and put it on select screens at AMC Theatres,” Bernards said. “In the movie, three Chinese men tour Thailand and all of this wacky stuff happens. They advertised it as China’s version of The Hangover. No one came.”

Box Office Mojo reported that Lost in Thailand made only about $57,000 in the U.S.

However, there has been some headway in stimulating business interests between the U.S. and China.

In November 2014, President Obama announced that both countries would begin granting each other’s citizens longer visas.

For the film industry, it might not have much of an immediate impact, Rosen noted. Most major movie studio offices in Beijing or Shanghai tend to be headed by Chinese nationals who hold green cards with a lot of experience in the U.S.

But, he added, the new visa regulations are an important step forward.

“It promotes a sense of sustainability and permanence in the relationship, and should be valuable for Americans who, for business reasons, will be based in China for a considerable period of time,” he said. “With more Chinese investment coming in to the U.S., it should help on that end as well.”